Cloud cost surprises rarely come from a single bad decision.

They build quietly, long before Finance sees a spike on the invoice.

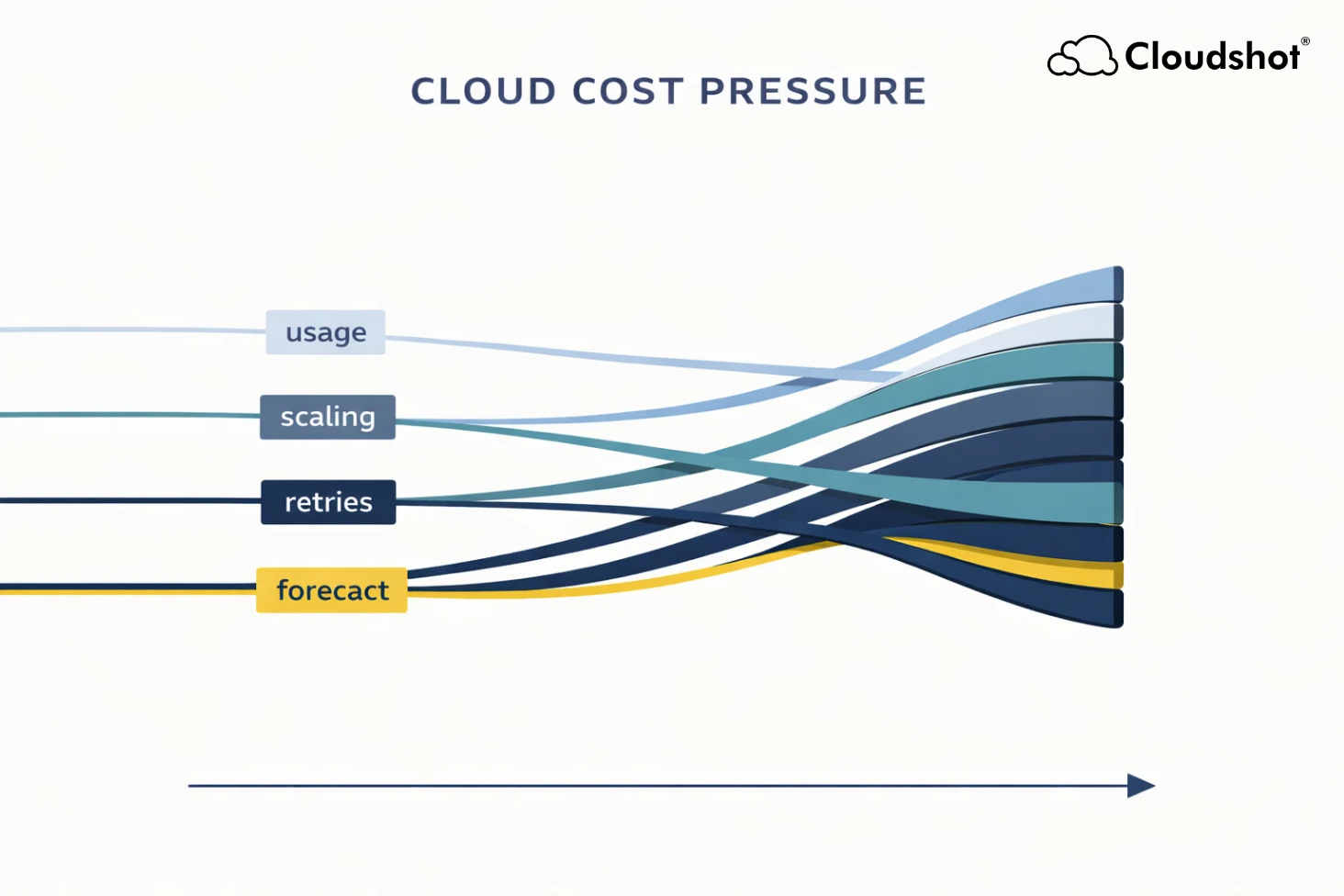

Usage patterns shift. Systems adapt. Infrastructure behaves exactly as designed. Yet cost pressure accumulates in the background, unnoticed until it becomes a financial problem.

This is why modern FinOps is less about reacting to bills and more about anticipating pressure.

Why Cost Pressure Forms Early

Cloud systems are elastic by design.

Autoscaling absorbs demand.

Retries protect reliability.

Traffic routing optimizes performance.

Each mechanism improves resilience. But each also changes how resources are consumed.

A small increase in traffic can trigger additional capacity.

A minor latency issue can amplify retries.

A configuration tweak can shift usage across regions or services.

Nothing breaks. No alerts fire.

But usage grows—and so does cost.

Why Invoices Arrive Too Late

By the time Finance reviews cloud spend, the pressure has already materialized.

Traditional cost reports answer:

How much did we spend?

Where did it go?

They don't answer:

What behavior caused this?

When did pressure start building?

Which systems amplified usage?

This gap forces FinOps teams into explanation mode instead of control mode.

Variance discussions happen after the fact.

Forecasts lose credibility.

Trust erodes between Finance and Engineering.

Cost is a Behavior Signal

Cloud spend follows system behavior.

It rises when traffic patterns shift.

It increases when systems compensate for degradation.

It expands when scaling responds to load.

Treating cost as a billing artifact hides this reality.

Effective FinOps treats cost as a signal—one that reflects how infrastructure is behaving over time.

To act early, teams need visibility into:

behavior changes

dependency impact

usage amplification

ownership context

Moving from Reactive to Predictive FinOps

Predictive FinOps doesn't require perfect forecasting. It requires early indicators.

Teams need to know:

when usage patterns deviate from normal

where pressure is accumulating

which services are likely to drive spend next

When these signals are visible early, Finance regains leverage.

Budgets become guides instead of constraints.

Forecasts become credible.

Conversations become proactive instead of defensive.

How Cloudshot Supports Early Cost Awareness

Cloudshot helps FinOps teams identify cost pressure before it reaches the invoice by connecting:

live infrastructure behavior

change timelines

dependency relationships

cost and usage signals

Instead of waiting for the bill, teams can see cost risk forming in real time.

This shifts FinOps from reporting spend to managing behavior.

A Familiar Scenario

Mid-month, usage begins creeping upward.

Nothing appears broken. Engineering sees healthy systems. Finance hasn't noticed yet.

With early cost pressure visibility, FinOps can trace:

a routing change → traffic redistribution → scaling response → projected spend increase.

The issue isn't waste. It's emerging pressure.

And because it's visible early, teams can act.

Prevention is the Real Optimization

The most effective FinOps teams don't optimize after overspending. They prevent overspending by recognizing pressure early.

That's the difference between managing bills and managing cloud behavior.